Sunday, March 26, 2006

Thursday, March 23, 2006

Demonstrations in France

Right now in France, there are large demonstrations against a new employment law (Contrat de Première Embauche or CPE) targeting the young (less than 26 years old) people. If the law is passed, employers will gain more flexibility in hiring and firing young people during a two years period. The employer won't be required to motivate the layoff anymore, which will be effective immediatly. After the two years period, the CPE would transfer to a standard Contrat à Durée Indéterminée (or CDI) where it's tougher to fire employees.

The logic behind this law is to create more flexibility in the job market and encourage companies to hire staff without the threat of costly dismisals in case the company goes south. It also allows a boss to evaluate the performances of an employee on a longer period of time although two years seems a lot for that.

This has created an uproar in France and more than 70% of the population seems to want the law modified or rejected. It might seems hard to understand for an American or a British where job contracts in their respective countries are much more flexible, but this is a strong change in France.

However, I see two problems with it: i) why is the law targeted only to the young people? ii) why a two years trial period?

The logic behind this law is to create more flexibility in the job market and encourage companies to hire staff without the threat of costly dismisals in case the company goes south. It also allows a boss to evaluate the performances of an employee on a longer period of time although two years seems a lot for that.

This has created an uproar in France and more than 70% of the population seems to want the law modified or rejected. It might seems hard to understand for an American or a British where job contracts in their respective countries are much more flexible, but this is a strong change in France.

However, I see two problems with it: i) why is the law targeted only to the young people? ii) why a two years trial period?

i) By targeting the young only, this law is creating a discrimination between age categories. The argument for this is that unemployment is higher with young people than in other age categories but official numbers of 25% unemployed might be misleading. The Financial Times has reported last week end that because of longer studies, young people are out of the job market for much longer that is other countries. Adjusted values are "7.8 percent of French under-25s are actually out of work, as compared with 7.4 percent in Britain and 6.5 percent in Germany." (reported in the IHT as well)There is no magic bullet to solve that problem but I think the law needs to be adapted from its current version but since prime minister Villepin seems to hold on to its position, more demonstrations are likely. France is definitely a difficult country to reform...

ii) One year should be more than enough to assess the skills of an employee. Even the UK is trying to reverse the two years period back to one year (official text here and explanation here) although Germany is increasing it from six months to two years, with little if any demonstration planned.

Sunday, March 19, 2006

Spring Break

The Spring term is over. I'm not yet on holiday since I have a block week starting this Monday but an atmosphere of holiday is hovering in my head already... The end of this term also means the end of the MBA for a quite large number of students. Some are starting to work, some are travelling around the world and will start work in June/July so there is also an atmosphere of farewell at School.

For my part, it's four weeks of holidays including two in North India with my girlfriend and then a light Summer term. Then, the day after graduation in July, I plan to leave for two months backpacking, probably in South America and then back in London in September for the job. As I will become a management consultant, I read the post of Angel Angie with some interest. I hope I won't become this incompassionate freak you are describing...

For my part, it's four weeks of holidays including two in North India with my girlfriend and then a light Summer term. Then, the day after graduation in July, I plan to leave for two months backpacking, probably in South America and then back in London in September for the job. As I will become a management consultant, I read the post of Angel Angie with some interest. I hope I won't become this incompassionate freak you are describing...

Thursday, March 16, 2006

What are the hot jobs for MBAs?

According to this article from the New York Sun, the Private Equity industry and Hedge Funds are the two sectors that are attracting the most applicants. "Almost 75% of HBS students want to do private equity or venture capital. Only about 10% get to do it" according to a member of HBS student senate. The trend is the same at Wharton and Columbia with a lot of people trying to get in but little succeeding. I don't know the numbers at London Business School but my guess is that it's around the same lines since the Private Equity Club is quite successful in terms of membership.

For the Investment Banking guys, the place to be is increasingly becoming London, according to this article from Newsweek. The City is overtaking Wall Street in terms of IPOs and European M&A is now larger than US M&a. However, American banks are of course dominating the place.

For the Investment Banking guys, the place to be is increasingly becoming London, according to this article from Newsweek. The City is overtaking Wall Street in terms of IPOs and European M&A is now larger than US M&a. However, American banks are of course dominating the place.

Friday, March 10, 2006

I am a millionaire...

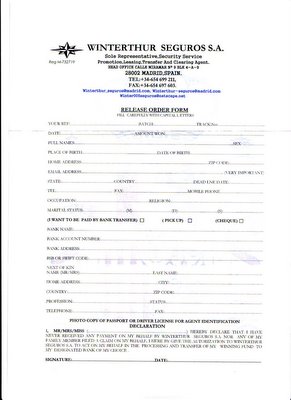

I received a letter from the Loterias y Apuestas des Estado yesterday, which is apparently a lottery program in Spain. The letter was in English and was giving me instruction to claim my EUR1,498,160 prize from a huge international Spanish-based lottery.

I was so happy… With that money, no more headaches to pay back the loan or buy a house or take some really nice holidays…

But wait a minute… How could I win to a lottery I haven’t bought a ticket for? And why do they want a copy of my passport and all possible information about my bank account? And why is this printed with an ink jet printer on cheap paper? And why is the contact phone number starting with a “6” which is the code for a mobile number in Spain?

I did a quick check on the Internet and obviously, this is a lottery scam. Once you make contact with the fake lottery company, they’ll ask you various fees for taxes, money transfer and so on and try basically to suck money out of you before disappearing.

I don’t think any reader of this blog will fall for such a lousy scam but I’m posting copies of the letter and I’m reporting them to the Spanish authorities and I hope they'll catch those idiots.

Links explaining the Spanish Lottery Scam:

http://www.fraudwatchinternational.com/internet/lottery.shtml

http://www.elgordo.com/info/scamsen.asp

http://travel.state.gov/travel/cis_pa_tw/cis/cis_2475.html

Copy of the two pages letter received to my UK address:

I was so happy… With that money, no more headaches to pay back the loan or buy a house or take some really nice holidays…

But wait a minute… How could I win to a lottery I haven’t bought a ticket for? And why do they want a copy of my passport and all possible information about my bank account? And why is this printed with an ink jet printer on cheap paper? And why is the contact phone number starting with a “6” which is the code for a mobile number in Spain?

I did a quick check on the Internet and obviously, this is a lottery scam. Once you make contact with the fake lottery company, they’ll ask you various fees for taxes, money transfer and so on and try basically to suck money out of you before disappearing.

I don’t think any reader of this blog will fall for such a lousy scam but I’m posting copies of the letter and I’m reporting them to the Spanish authorities and I hope they'll catch those idiots.

Links explaining the Spanish Lottery Scam:

http://www.fraudwatchinternational.com/internet/lottery.shtml

http://www.elgordo.com/info/scamsen.asp

http://travel.state.gov/travel/cis_pa_tw/cis/cis_2475.html

Copy of the two pages letter received to my UK address:

Page 1: Congratulations, you've won almost EUR 1.5m

Thursday, March 09, 2006

France higher education

Critics of France's often say that it's model is outdated, including a higher education system that cannot compete against Anglo-Saxon Universities such as MIT, Harvard, Oxford and so on...

That may be true in some areas but in one field, the French are still the best. And believe it or not, it's in a finance related subject and it's the very american Wall Street Journal who is saying it. The Journal's front page of today (via Factiva) is about a French university teacher, Ms. El Karoui, that has a world wide reputation in the derivatives industry. Students at Paris VI and Ecole Polytechnique that are following her courses are actually putting her name on their CVs and it almost guaranteed them a job at a derivatives desk in any global investment bank with a starting salary of $140,000.

So much for an outdated model :)

That may be true in some areas but in one field, the French are still the best. And believe it or not, it's in a finance related subject and it's the very american Wall Street Journal who is saying it. The Journal's front page of today (via Factiva) is about a French university teacher, Ms. El Karoui, that has a world wide reputation in the derivatives industry. Students at Paris VI and Ecole Polytechnique that are following her courses are actually putting her name on their CVs and it almost guaranteed them a job at a derivatives desk in any global investment bank with a starting salary of $140,000.

So much for an outdated model :)

Wednesday, March 08, 2006

Disparition of a great African musician

Ali Farka Touré died today. He was one of the best musicians of Africa and gained international reputation following his Grammy Award in 1994 for Talking Timbuctu with Ry Cooder. If you like blues or are interested in new sounds, listen to Touré. You can also try Mali to Memphis, a great album contrasting African music with American blues.

Tuesday, March 07, 2006

Economic patriotism

I was reviewing a document that our M&A professor gave us today: it's the list of all M&A deals in 2005 from Investment Dealer's Digest and it provides interesting statistics.

French companies have been really active overseas and France was also a good market for foreign buyers:

In particular in the Suez case, Enel should make its bid for Suez and the French government should not oppose it. Gaz De France could still counterbid or E.On could play the role of a white knigt but in the end, Suez shareholders should be able to evaluate more than one offer and settle for the one that offers the most value.

To be fair to the French, many other countries are doing the same (or even worse): Spain talks about preventing E.On to buy Endesa and the US Congress is trying to prevent a Dubai based company to buy some US port operations for national security concerns. Even the UK hinted earlier this year that it would take a hard look at a possible bid from Gazprom against Centrica.

For a round up on the return of protectionism around the world, have a look at this article from The Economist.

French companies have been really active overseas and France was also a good market for foreign buyers:

- France is the third most active country for acquisitions in the US (behind Canada and the UK) with 60 deals worth $6bn and conversely, US companies have made 75 acquisitions in France worth $11bn, making France its fifth most attractive country

- France is the second biggest buyer of other EU companies behind The Netherlands with 199 deals worth $75.1bn and conversely, 165 acquistions have been performed in France by EU companies, worth $19bn

In particular in the Suez case, Enel should make its bid for Suez and the French government should not oppose it. Gaz De France could still counterbid or E.On could play the role of a white knigt but in the end, Suez shareholders should be able to evaluate more than one offer and settle for the one that offers the most value.

To be fair to the French, many other countries are doing the same (or even worse): Spain talks about preventing E.On to buy Endesa and the US Congress is trying to prevent a Dubai based company to buy some US port operations for national security concerns. Even the UK hinted earlier this year that it would take a hard look at a possible bid from Gazprom against Centrica.

For a round up on the return of protectionism around the world, have a look at this article from The Economist.

Outcome of VCIC

VCIC was great. Our team did not win but I had great fun and learned a lot about how VCs assess opportunities and how entrepreneurs should pitch when trying to raise capital.

The competition worked this way:

The competition worked this way:

- Business plans from 5 real companies looking to raise venture capital were given to us on Thursday at 6pm. As a team, we assessed the plans and developed a list of questions for the due diligence session.

- On Friday 1pm, the entrepreneurs presented their companies. 10mn presentation each during which teams were not allowed to ask questions.

- From Friday 3pm to 6pm, each team rotated with the entrepreneurs and was allowed to ask questions during 15mn.

- The investment decision (term sheet, presentation and executive summary) was then due on Saturday noon and presentations with Q&A from judges occurred in the afternoon

Wednesday, March 01, 2006

Back from the Big Apple

New York was really cool but freezing... We did party a lot, sleep little and it was a great extended week-end overall. Couple of pictures below:

The return trip was not that great and I was actually quite disapointed with British Airways. The service was relatively OK on board and we landed on time but it then took us more than an hour to move from the plane to the Heathrow terminal because buses were unavailable... I could not believe this...

Back in London, the reality was tough: dozens (if not hundreds) of unread emails and couple of projects were I was late and little time to rest since tomorrow is the beginning of the VCIC competition. I'm getting ready for 3 days of hard work and no sleep but it will probably be very instructive and fun.

The return trip was not that great and I was actually quite disapointed with British Airways. The service was relatively OK on board and we landed on time but it then took us more than an hour to move from the plane to the Heathrow terminal because buses were unavailable... I could not believe this...

Back in London, the reality was tough: dozens (if not hundreds) of unread emails and couple of projects were I was late and little time to rest since tomorrow is the beginning of the VCIC competition. I'm getting ready for 3 days of hard work and no sleep but it will probably be very instructive and fun.